Trading forex involves more than just buying and selling currencies. Hidden costs like swaps, overnight financing charges, and slippage can affect your actual profit. Understanding how these costs work helps you manage risk and avoid unnecessary losses.

In this guide, we’ll break down the main costs, explain when they apply, and show practical ways to reduce them.

Why Forex Trading Costs Matter

Forex trading uses leverage and frequent execution, so even “small” costs add up over time.

These costs impact traders in different ways:

- Day traders make frequent entries and exits, so spreads and commission accumulate across dozens of trades.

- Swing traders hold trades overnight, leading to compounding swap charges over days or weeks.

- Scalpers rely on tiny price movements, meaning spreads and slippage can quickly erase profits.

- High-lot or high-leverage traders trade larger positions, where even minor spread widening or partial fills can create unexpected costs.

And because forex positions are often magnified by leverage, a few dollars per night in swap or a 1-2 pip difference in execution can significantly impact long-term performance.

Tip: Track your monthly trading costs (spreads, swap, commissions) to understand how much they affect your net returns.

What Are Swaps / Overnight Fees?

A swap (sometimes called an overnight fee) is the cost you pay for holding a position overnight. It’s based on the interest rate difference between the two currencies in a currency pair.

When you hold a trade overnight, you may pay or earn interest depending on whether you’re long or short and how interest rates compare.

Why Do Swaps Exist?

Every currency has its own central bank interest rate. When you buy one currency and sell another, you’re effectively borrowing one and lending the other. The difference between these two rates = the overnight financing cost.

When Do Swaps Apply?

Swaps are typically charged or credited at the end of each trading day, based on the open positions you’re holding past the platform’s rollover time. Most brokers apply a triple swap on one specific weekday (usually Wednesday) to account for weekend financing, since markets are closed but interest still accrues.

What Affects Swap Size?

Interest rate differences: Swap rates are largely determined by the gap between the interest rates of the two currencies in a pair. When central banks change their rates, the swaps for affected pairs usually shift too.

Currency pair: Each pair has a unique rate differential, so swaps aren’t the same across all pairs.

Trade direction: Going long or short affects whether the swap is credited or debited, because you’re effectively borrowing one currency and lending another.

Broker adjustments: Brokers may add their own funding costs or markups, so swap amounts can vary slightly from platform to platform.

Swap-Free (Islamic) Accounts

Some traders use swap-free accounts for religious reasons. These accounts don’t charge (or credit) overnight interest, but may use alternative fees, so they’re not purely “free trading.”

Swap Calculation Example

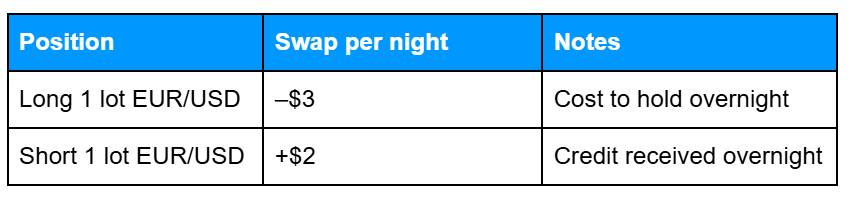

Suppose you decide to go long 1 standard lot of EUR/USD. Your broker applies the following swap rates:

If you hold your long trade for 5 nights, the swap cost adds up: 5 nights x $3 = $15

This $15 might seem small at first, but if you hold multiple positions, or maintain trades over several weeks or months, swap costs can significantly impact your overall profit or loss.

Tip: Always check the swap rates before opening a trade, especially if you plan to hold positions overnight. This helps you factor in the true cost of your trades.

What Is Slippage in Forex?

Slippage happens when your order is executed at a price different from what you expected. It’s a natural part of trading, especially when the market moves quickly.

Why Does Slippage Occur?

- Fast price movement: Prices can change between the moment you place your order and when it is filled.

- Low liquidity: Less-traded currency pairs or odd market hours can make it harder to fill orders at your requested price.

- News announcements: Major economic releases can cause sudden spikes or drops.

- Opening gaps: Overnight or weekend market openings may have prices significantly different from the previous close.

Example:

You place a buy order for EUR/USD at 1.20000. If the market jumps, the order might fill at 1.20030, creating a 3-pip difference.

Understanding Negative And Positive Slippage

Negative slippage: Your order fills at a worse price than expected, reducing potential profit or increasing a loss.

Positive slippage: Your order fills at a better price than expected, giving a small advantage.

Tip: Trade during high-liquidity sessions like the London/New York overlap, and avoid entering large trades during major news releases to reduce slippage risk.

Slippage Example

Suppose you set a buy order for EUR/USD immediately after an economic news release. The market moves rapidly:

- Requested price: 1.10500

- Executed price: 1.10520

Your order fills slightly worse than expected because the price moved before execution could complete. This type of slippage is normal and can happen during:

- Economic releases: Sudden news causes rapid price changes.

- Low-liquidity sessions: Thin trading volume makes it harder to fill orders at the requested price.

- Weekend market openings: Prices can gap significantly from Friday’s close.

- High volatility events: Large market swings can occur unexpectedly, creating temporary mismatches.

Tip: Understand that small slippage is part of trading, and using appropriate position sizes during volatile periods can help limit its impact.

Slippage vs Spread

Slippage and spread are often confused, but they are not the same.

- Spread: The difference between the bid and ask prices of a currency pair. It’s a built-in cost that applies to every trade.

- Slippage: Occurs when an order is executed at a different price than expected. It typically happens during high volatility, low liquidity, or major news events.

Spread is predictable and always present, whereas slippage is situational and can work for or against a trader.

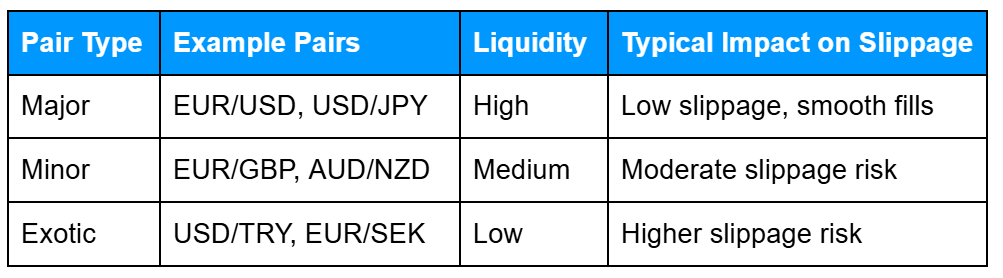

How Liquidity Impacts Slippage

Major pairs (like EUR/USD, USD/JPY) generally execute smoothly with minimal slippage because of high liquidity. Minor and exotic pairs can experience bigger gaps or partial fills due to lower liquidity, especially during off-peak sessions.

Tip: Trade high-liquidity pairs if you want more predictable fills and minimal slippage.

How to Reduce Trading Costs

Swaps

- Check swap rates before holding overnight: Some positions carry higher overnight fees than others.

- Close high-cost positions early: Reduces the impact of overnight charges.

- Consider shorter holding periods: Only hold long-term if your strategy requires it.

- Be mindful of weekends: Many brokers apply triple swaps mid-week to cover non-trading days.

Slippage

- Avoid major news releases unless intentional: Prices can jump suddenly, causing execution at unexpected levels.

- Use limit orders where possible: Gives more control over entry and exit prices.

- Trade high-liquidity sessions: London/New York overlaps tend to fill trades more reliably.

- Be cautious during low-volume hours: Market opens or thin sessions may see wider swings.

Tip: Factor in triple swaps and slippage when planning trade duration and position size: small costs add up over time.

Common Mistakes to Avoid

Many traders underestimate how costs can affect profitability over time. Even small fees per trade add up, especially with frequent trading or larger positions. Common mistakes include:

- Assuming overnight fees don’t matter: Swaps can quietly eat into profits if you hold positions regularly.

- Ignoring swap differences between brokers: Not all brokers offer the same rates; a position held overnight might cost more or less depending on your provider.

- Holding trades accidentally through triple-swap days: Some brokers apply triple swaps mid-week to cover weekends, so holding trades unintentionally can lead to higher costs.

- Trading during major news unknowingly: Slippage often occurs during economic announcements, increasing execution costs.

- Confusing slippage with the spread: Spreads are predictable, but slippage is situational—treat them differently when planning trades.

Tip: Track all hidden costs carefully. Over weeks or months, they can significantly impact your results, even if each trade seems small.

Frequently Asked Questions

Q: What is an overnight fee?

A: It’s a charge (or credit) for keeping a trade open overnight. It comes from borrowing one currency while lending another, so the fee depends on your trade direction and the interest rates of the currencies.

Q: When is a swap charged?

A: Usually at the end of each trading day. Many brokers apply a “triple swap” once a week to cover the weekend, so that day’s fee is multiplied by three.

Q: Is slippage always bad?

A: Not at all. Negative slippage means your order fills at a worse price than expected. Positive slippage happens when it fills at a better price. Big moves or low liquidity often cause both.

Q: Are swap-free accounts cheaper?

A: Not always. Brokers may replace swaps with admin or financing fees, so check the fine print.

Q: How can I reduce overnight fees?

A: Avoid holding trades overnight unless planned, pick currency pairs with smaller interest differences, and keep an eye on trade size. Small fees can add up if ignored.

Q: How can I avoid slippage?

A: Use limit or stop orders instead of market orders, and trade during high-liquidity sessions like London/New York overlaps. Avoid major news events if you want more predictable fills.

Related Articles

- Forex Trading Basics: How It Works & Key Concepts

- Forex Mechanics: Leverage, Position Sizing & How Execution Works

- Forex Risk & Profitability: Factors Affecting Prices, Trading Risks & Safe Strategies

Next Steps

Want to learn more?

Find out how risk, costs, and trading strategies affect your potential profits in our next article.