Forex trading can be exciting and potentially profitable, but it also comes with real risks. Prices move for many reasons, and without understanding what drives them, how leverage affects your trades, and how to manage risk, losses can quickly add up.

In this guide, you’ll learn the key factors that influence currency prices, common mistakes traders make, and practical strategies to trade safely and manage your forex risk effectively.

What Affects Currency Prices?

Currency prices don’t move randomly, they reflect a mix of economic, political, and market forces. Understanding these factors can help you anticipate potential price movements and trade more wisely.

Economic indicators

Reports like GDP, inflation, and employment figures, as well as central bank interest rate decisions, give clues about a country’s economic health. Strong data often strengthens the currency, while weak data can push it lower.

Political events

Elections, policy changes, and geopolitical tensions can create uncertainty. Traders often react quickly to news that may affect trade, government spending, or monetary policy.

Market sentiment

Prices are influenced by traders’ expectations and risk appetite. For example, in times of uncertainty, investors may flock to “safe-haven” currencies like USD or JPY.

Volatility cycles

Currency markets move in waves. High-volatility periods bring larger swings, creating opportunities and risks, while low-volatility periods see smaller, steadier price changes.

Example:

A strong U.S. jobs report may boost USD value against EUR because traders expect higher interest rates.

Tip: Always check the economic calendar to anticipate potential market-moving events and plan your trades accordingly.

Is Forex Trading Profitable?

Forex trading can be profitable, but it’s not a guaranteed path to quick money. Success depends on a combination of skill, discipline, and risk management.

- Strategy and skill: Traders who consistently make profits follow well-defined plans. Random trades or emotional decisions usually lead to losses.

- Capital management: Having enough funds in your account to absorb losses is crucial. Undercapitalized accounts can be wiped out by a few bad trades.

- Risk control: Using leverage wisely and setting stop-loss orders helps protect your account from large drawdowns. Reckless risk-taking is a common reason traders fail.

- Market conditions: Volatility can create opportunities for profit, but it also increases the chance of rapid losses. Understanding when to trade or when to stay out is part of profitability.

Tip: Profits are achievable, but careful risk management is just as important as spotting opportunities.

What Affects Profitability in Forex Trading?

Profitability in forex trading depends on several interconnected factors:

Leverage And Position Sizing

Leverage can amplify both profits and losses. Using higher leverage increases potential gains on small market moves, but also exposes your account to larger losses.

Example:

With 1:50 leverage, a 2% market move could translate into a 100% gain or loss relative to your margin.

Risk Management

Effective risk management protects your capital. Using stop-losses, diversifying trades, and limiting risk per trade (typically 0.5-2% of your account) helps prevent a single loss from wiping out significant funds.

Execution And Costs

Even winning trades can see reduced profitability due to spreads, overnight swaps, or slippage during execution. Understanding these costs is essential for realistic expectations.

Discipline And Planning

Profitability isn’t just about strategy, it’s also about mindset. Emotional trading, revenge trades, or chasing losses can quickly erode gains. Planning trades in advance and sticking to your rules keeps risk under control.

Why Do Many Forex Traders Lose Money?

Trading forex is challenging, and several common mistakes can quickly eat into profits or cause losses. Even when you understand the factors affecting profitability, traders often fall into common traps that can quickly erode gains.

Over-Leverage

Using too much borrowed money can turn small price moves into large losses. Leverage magnifies both gains and losses, so it needs careful management.

Lack of Knowledge

Trading without understanding the market, instruments, or costs leaves traders exposed to surprises and mistakes.

Emotional Decisions

Fear, greed, and overconfidence often lead to impulsive trades, poor timing, or abandoning a strategy.

Ignoring Risk per Trade

Not sizing trades according to account size can make losing streaks more damaging. For example, risking 1% per trade on a $500 account costs $5 per loss, but repeated losses compound quickly.

Chasing Losses

Trying to “win back” lost money by increasing trade sizes or taking risky trades can turn minor setbacks into major drawdowns.

Example:

Risking 1% per trade on a $500 account, a 5-trade losing streak costs $25. It’s not a huge loss, but repeated patterns can compound.

Can Forex Trading Be a Full-Time Career?

Forex trading can be a source of part-time supplementary income for many traders. Turning it into a full-time career is possible, but it’s challenging and requires sufficient capital, strict discipline, and solid experience. Expect a learning curve that can span months or even years, with profits growing gradually as skills and strategies improve.

Tip: Treat trading like a business. Plan each trade, keep a detailed journal, track your performance, and regularly review your strategies to improve over time.

How Much Capital Do You Need to Start Forex Trading?

The amount of capital you start with affects your trading flexibility, risk tolerance, and the types of positions you can take.

- Small accounts ($100–$500): Ideal for practicing and learning the mechanics of trading. Micro lots let you test strategies with minimal risk, but significant profits are unlikely.

- Medium accounts ($1,000–$5,000): Suitable for more serious trading. You can manage risk effectively, place multiple trades, and begin applying proper position sizing and leverage techniques.

- Large accounts ($10,000+): Allow full strategy deployment with access to standard lots, diversified positions, and more aggressive leverage while keeping risk controls in place.

Tip: Never trade money you can’t afford to lose, and avoid borrowing funds to trade. Your capital should support learning and risk management, not create financial stress.

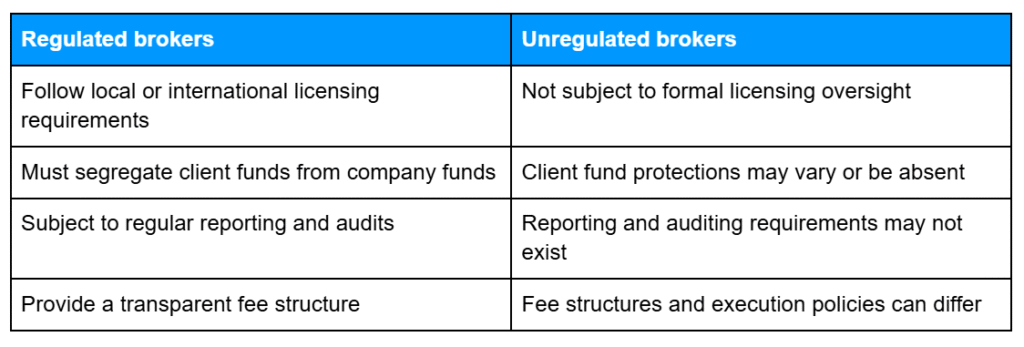

How Forex Brokers Are Regulated

Regulation is essential to protect traders and maintain fair trading practices. Brokers that are regulated must follow strict rules around capital requirements, reporting, and the segregation of client funds. This ensures that your money is handled safely and that trading is transparent.

Unregulated brokers, on the other hand, may expose traders to higher risks, including hidden fees, poor execution, or even fraud.

Tip: Always verify your broker’s licenses with the relevant regulatory authority and read the terms and conditions before funding an account.

Common Mistakes and Misconceptions

Many traders stumble because of unrealistic expectations or overlooked details. Some of the most common pitfalls include:

- Expecting overnight riches: Profits take time and consistent effort.

- Trading without a plan or strategy: Random trades often lead to losses.

- Ignoring costs: Spreads, swaps, and slippage can quietly eat into profits.

- Trading high-risk instruments without experience: Volatility can wipe out accounts quickly.

- Believing past wins guarantee future success: Each trade is independent; discipline matters more than luck.

Tip: Focus on discipline and sound risk management, as these are more important than having the “perfect” strategy.

Practical Tips for Safe Trading

Trading forex can be risky, but following a few disciplined practices helps protect your account and build consistent results.

- Set risk limits: Decide how much you’re willing to risk per trade and stick to it.

- Keep a trading journal: Track trades, mistakes, and lessons learned.

- Manage news exposure: Avoid major economic announcements unless you’re prepared for volatility.

- Practice on a demo account: Test strategies and position sizing before trading live.

- Review broker fees and policies: Check spreads, swaps, and account rules regularly.

- Focus on consistent gains: Aim for steady progress rather than chasing big wins.

Frequently Asked Questions

Q: What affects currency prices?

A: Currency prices move due to economic indicators (like GDP, inflation, and employment reports), political events (elections or policy changes), overall market sentiment, and periods of high or low volatility.

Q: Can you make money trading forex?

A: Yes, but consistent profitability requires a combination of skill, disciplined strategy, effective risk management, and careful capital allocation.

Q: Why do many traders lose money?

A: Common reasons include over-leveraging, trading without sufficient market knowledge, letting emotions drive decisions, and neglecting proper risk management.

Q: How much capital do I need?

A: It depends on your strategy and risk tolerance. Micro accounts can start around $100, but most serious trading requires $1,000 or more to manage risk effectively.

Q: How are brokers regulated?

A: Regulated brokers follow strict rules for capital, reporting, and client fund protection. Unregulated brokers may expose traders to fraud, hidden costs, or poor execution.

Related Articles

- Forex Trading Basics: How It Works & Key Concepts

- Forex Mechanics: Leverage, Position Sizing & How Execution Works

- Forex Trading Costs: Swaps, Overnight Fees & Slippage

Next Steps

Want to learn more?

Find out how forex trading works in our forex trading and key concepts primer.