Trading crypto via CFDs can offer profit opportunities, but leverage and market volatility mean risks are significant. Understanding these factors is essential for safe, informed trading. To trade safely and make informed decisions, it’s important to understand what affects profitability, common mistakes traders make, and essential safety practices.

In this guide, you’ll learn about crypto trading risks, practical strategies to manage them, and realistic expectations for gains and losses.

Is Crypto Trading Profitable?

Profit is possible with crypto CFDs, but it’s never guaranteed.How much you can earn depends on your strategy, discipline, and risk management. Crypto markets are highly volatile, which means prices can swing dramatically in a short time, creating opportunities for returns but also increasing the risk of losses if trades aren’t carefully planned.

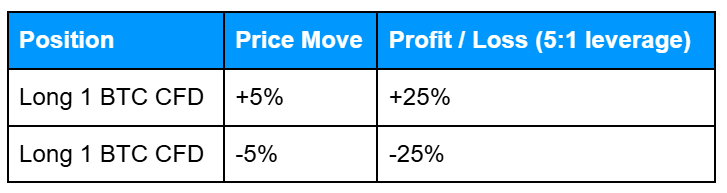

For example, trading 1 BTC CFD with leverage means a 10% price move could either produce significant gains or wipe out a substantial portion of your account. Understanding this balance is key to approaching trading realistically and planning each CFD position carefully.

Leverage magnifies both potential gains and losses. Managing risk is essential to avoid significant drawdowns.

Can You Make Money Trading Crypto?

Yes, but consistent gains require more than luck. Success depends on a combination of skill, discipline, and effective risk management. Key factors include:

- Skill and knowledge: Understanding the assets you trade, CFD mechanics, leverage, and the tools at your disposal.

- Capital management: Ensuring your account size can withstand losing streaks without jeopardizing your trading plan.

- Risk control: Avoiding over-leveraging, using stop-loss orders, and sizing positions appropriately to protect your capital.

Practical insight: Even experienced traders accept occasional losses. The goal isn’t to avoid losses entirely, but to manage risk so you can stay in the market and trade consistently over time.

What Are Crypto Trading Risks?

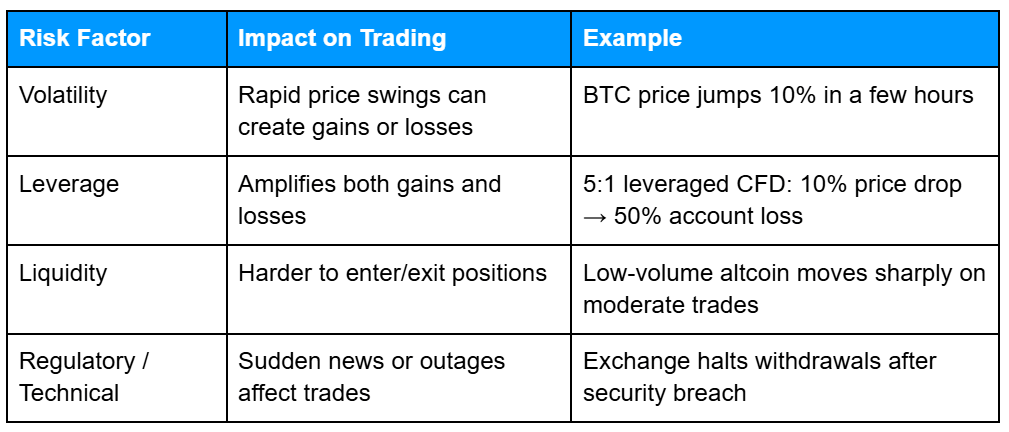

Trading crypto CFDs carries several risks that can impact your capital and decision-making. Awareness of these risks allows you to plan trades effectively and set realistic expectations.

This breakdown helps traders quickly see which factors influence positions and where risk management is most critical.

Additional Risk Considerations

- Market volatility: Even minor news or rumors can trigger significant gains or losses within hours.

- Leverage risk: CFD positions amplify both gains and losses, making careful risk management essential.

- Liquidity risk: Some cryptocurrencies have low trading volumes, intensifying losses during market swings.

- Regulatory and technical risks: Changes in law, exchange outages, or network issues can prevent trades from executing.

- Emotional trading: Fear, greed, and impulsive decisions can worsen losses. Maintaining discipline and following your strategy is critical.

Tip: By understanding these risks, you can plan trades carefully, use stop-loss levels, and approach the market with realistic expectations.

Why Do Many Crypto Traders Lose Money?

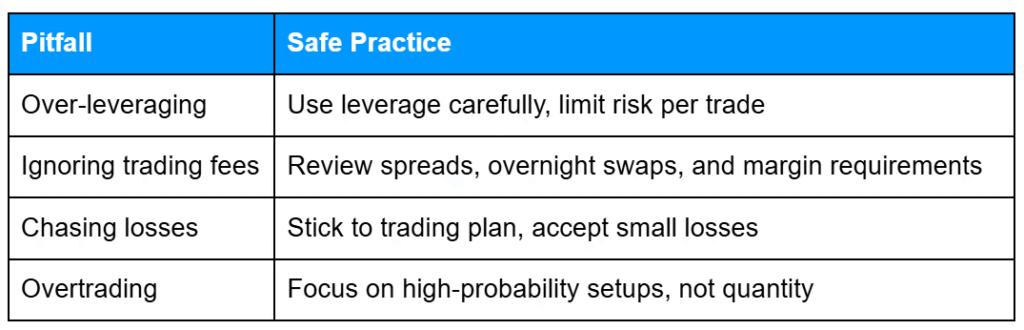

Even experienced traders can fall into common traps that erode capital and undermine strategy. Key pitfalls in crypto CFD trading include:

Excessive leverage

Using high leverage without experience can quickly magnify losses. For example, trading 1 BTC CFD with 5:1 leverage means a 10% adverse price move could wipe out 50% of your account.

Ignoring trading costs

Fees, spreads, and overnight funding charges may seem small individually, but they accumulate over time and reduce overall profitability, especially for frequent traders.

Poor risk management

Failing to set stop-losses, size positions appropriately, or follow a risk plan increases the likelihood of large, avoidable losses.

Chasing losses

Trying to recover previous losses often leads traders to make impulsive decisions or deviate from strategy.

Overtrading in volatile markets

Trading too frequently during periods of high volatility amplifies both financial and emotional risk.

Here’s a table summarizing the pitfalls crypto CFD traders encounter and the safe practices that mitigate these risks:

Tip: Awareness of these common pitfalls and actively managing them helps you protect capital, reduce losses, and trade more consistently.

Is Crypto Trading Worth It?

Crypto CFD trading can supplement income or, for experienced traders, develop into a full-time pursuit. Success depends on several key factors:

- Adequate capital: Starting with enough funds allows you to withstand losses and trade strategically without being forced to close positions prematurely.

- Strong risk management and discipline: Using stop-losses, sizing positions appropriately, and sticking to a clear trading plan protects your capital.

- Realistic profit expectations: Consistent gains take time, and losses are part of the process. Understanding this helps prevent frustration and impulsive decisions.

- Experience handling volatility: Comfort with rapid price swings is essential to maintain discipline and avoid emotional trading during market fluctuations.

Tip: Treat trading like a business. Plan your trades carefully, keep a detailed trading log, review performance regularly, and adjust your strategy based on results.

Is Crypto Trading Safe?

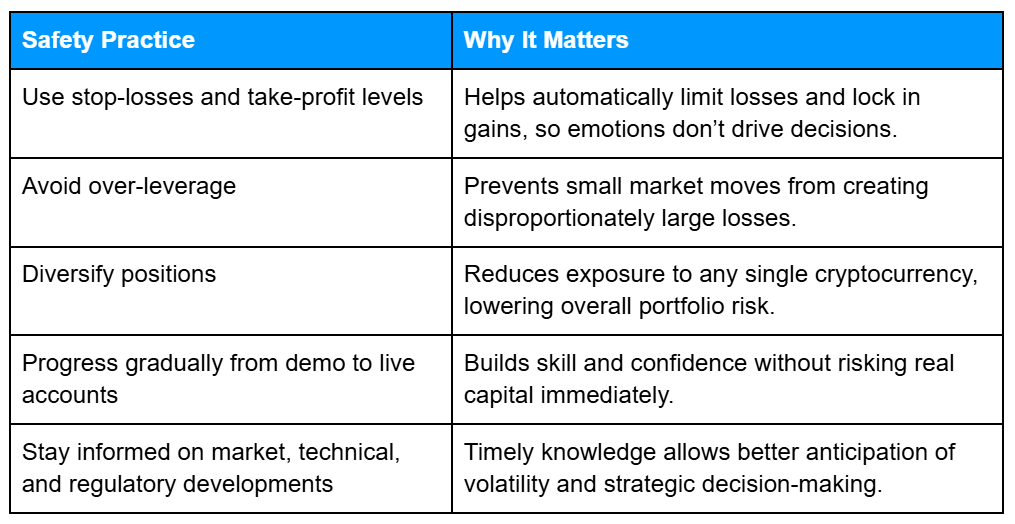

No trading is completely risk-free, but these safety practices can help protect your capital when trading CFDs:

Tip: Combining these practices with disciplined trading and realistic expectations helps you trade more safely and confidently.

Practical Tips for Safer Crypto CFD Trading

Trading crypto CFDs comes with unique risks due to leverage and derivative mechanics. Following these practical strategies can help you manage risk effectively and trade more responsibly:

- Set clear risk per trade limits: Risk only 0.5–2% of your account per CFD position. Leverage can amplify losses quickly.

- Keep a trading journal: Record each trade’s entry and exit, leverage used, and outcomes. Reviewing logs helps refine strategy.

- Avoid trading during major news unless prepared: CFD positions are highly sensitive to sudden market events.

- Start with demo accounts before live trading: Practice CFD mechanics, margin usage, and position sizing risk-free.

- Review broker fees, swaps, and margin policies: Understand spreads, overnight financing, and margin requirements to prevent unexpected losses.

- Focus on consistent small gains, not “big wins”: Leveraged CFDs magnify profits and losses; prioritize disciplined, incremental gains.

Tip: Integrating these practices into your daily CFD trading routine can help you stay disciplined, manage leverage wisely, and protect your capital over the long term.

Frequently Asked Questions

Q: Is crypto CFD trading profitable?

A: Profit is possible, but it’s not guaranteed. Success depends on your strategy, discipline, risk management, and understanding of leverage and market volatility.

Q: What are the main risks of crypto CFD trading?

A: Key risks include market volatility, leverage amplification, liquidity issues, regulatory or technical events, and emotional trading decisions. Awareness and planning help manage these risks.

Q: Can I lose all my capital trading crypto CFDs?

A: Yes, if trades aren’t managed carefully. Using stop-losses, controlling position sizes, and managing leverage helps limit potential losses.

Q: How can I trade crypto CFDs more safely?

A: Set clear risk limits per trade, use stop-losses and take-profit levels, start with demo accounts, review broker policies, and stay informed about market, technical, and regulatory developments.

Q: Do all cryptocurrencies carry the same level of risk?

A: No. Smaller or low-volume cryptocurrencies tend to be more volatile than major ones like Bitcoin or Ethereum, which are generally more stable.

Related Articles

- Crypto Trading Basics: Spot vs CFD and Blockchain Explained

- Crypto CFD Mechanics: How Trading and Leverage Work

- Crypto Market Factors: Understanding Volatility and Price Drivers

Next Steps

Want to learn more?

Ready to apply these strategies? Learn more about basics like spot vs crypto differences in our crypto trading primer.