Cryptocurrency CFDs are known for rapid price movements and high volatility. Prices can swing dramatically in a short time, influenced by a variety of market factors. Understanding these drivers is essential for making informed CFD trading decisions and managing risk effectively.

In this guide, we’ll break down the main crypto market factors that affect crypto prices, explain why the market can be so volatile, and provide practical tips for trading crypto CFDs safely and profitably.

What Affects Cryptocurrency Prices?

Cryptocurrency prices are influenced by a mix of market, economic, and technological factors. Understanding these drivers is essential not just for predicting price movements, but for managing risk effectively.

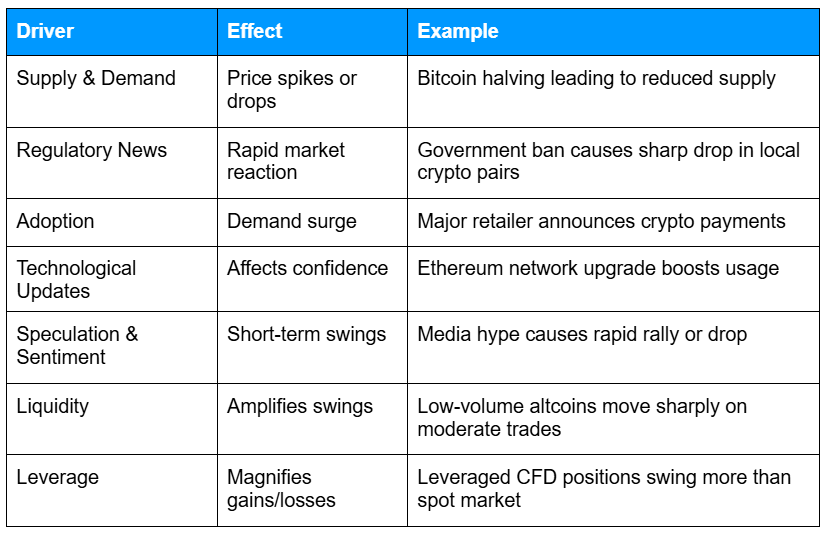

Below is a quick summary of the main drivers of crypto prices and their typical effects, with examples to illustrate how these factors influence trading decisions:

Supply and demand dynamics

Crypto prices respond to scarcity and demand, much like traditional markets. For example, Bitcoin’s limited supply can lead to sharp price increases when demand surges.

Regulatory news and government policies

Announcements from regulators or changes in legal frameworks can trigger rapid market reactions. A new policy banning or approving crypto in a major economy can shift prices overnight.

Adoption by companies, institutions, and investors

When corporations or large investors publicly adopt a cryptocurrency, demand often rises, pushing prices higher. These adoption milestones can create noticeable short-term price jumps.

Technological developments

Updates to blockchain networks, forks, or major software upgrades can influence confidence and usage. Such changes can directly affect how traders and investors value a cryptocurrency.

Speculative trading and market sentiment

Traders’ expectations, herd behavior, and media narratives often drive short-term price swings. Even small news items can sometimes spark significant market movements.

Low liquidity compared to traditional markets

Smaller trading volumes in some crypto pairs mean that even relatively modest trades can cause large price swings. This effect is especially noticeable in less popular cryptocurrencies.

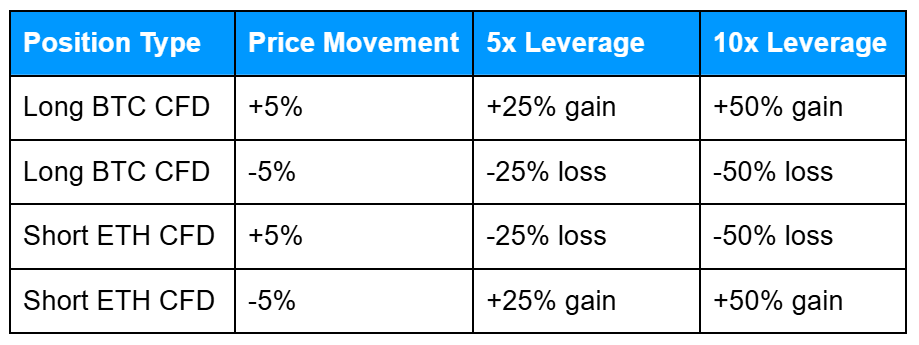

Impact of leverage on volatility

Using leverage amplifies both potential gains and losses, magnifying price movements in CFD and margin trading. Traders should be aware that leverage can make volatility even more pronounced.

Here’s a closer look at how leverage can amplify crypto price movements, showing potential gains and losses for the same price swings:

Crypto CFDs also involve unique trading features that affect risk and profitability. Traders can take short positions to profit from falling prices, pay overnight (rollover) fees when holding leveraged positions beyond a day, and experience the impact of spreads when entering or exiting trades.

Margin requirements mean positions can be liquidated automatically if losses exceed your available margin, so careful monitoring and risk management are essential.

Why Is Crypto So Volatile?

Volatility in crypto markets comes from a combination of structural and behavioral factors. Low liquidity, 24/7 trading, and leverage create conditions where even small events can lead to large price swings.

Market-moving events can trigger dramatic reactions:

- Regulatory announcements

- Security breaches or hacks

- Major exchange listings

- Sudden media coverage

Even a single tweet from a prominent figure or news of a blockchain incident can lead to double-digit swings within hours.

Behavioral factors also play a role:

- Herd behavior: Many traders reacting to the same news amplifies price swings.

- Market sentiment: Expectations and emotions can drive sudden moves even without fundamental changes.

Tip: Awareness of these factors allows traders to plan positions and manage risk more effectively in a volatile market.

Common Misconceptions About Crypto Volatility

- Volatility isn’t inherently bad: While rapid price swings create risk, they can also present opportunities for traders who manage positions carefully and follow disciplined strategies.

- Not all cryptocurrencies behave the same: Small-cap tokens tend to be far more volatile than major cryptocurrencies like Bitcoin or Ethereum, which are generally more stable.

- Volatility is not random: By understanding the underlying drivers such as market events, liquidity, and trader behavior, traders can anticipate potential movements and respond more intelligently.

Tip: Recognizing these misconceptions can help you approach volatile markets with a clearer, more strategic mindset.

Practical Tips To Manage Crypto Market Factors

Understanding the factors that drive crypto prices and the sources of volatility is one thing, applying that knowledge in your trading is another. The following tips can help you manage risk and make more informed decisions in volatile markets.

1. Stay informed

Keep an eye on economic, regulatory, and network updates for the cryptocurrencies you trade. Even small announcements can influence prices, so timely information is key to managing risk.

2. Use risk management strategies

Techniques like position sizing and stop-loss orders can help limit potential losses and protect your capital during sudden market swings.

3. Be cautious with leverage

Avoid high-leverage trades during major news events unless you are intentionally trading volatility. Leverage can magnify both gains and losses, so it’s important to use it carefully.

4. Keep a trading journal

Recording your trades, decisions, and outcomes helps identify patterns, learn from mistakes, and improve future trading strategies.

5. Plan for gaps

Overnight or weekend events can create gaps in cryptocurrency prices. Factor this into your position planning to avoid unexpected exposure.

Frequently Asked Questions

Q: Which cryptocurrencies are most volatile?

A: Smaller-cap coins and newly launched tokens tend to be more volatile than established ones like Bitcoin or Ethereum.

Q: Can news really move crypto prices that much?

A: Yes. Regulatory announcements, security breaches, or major adoption news can trigger rapid price swings.

Q: How does leverage affect crypto volatility?

A: Leverage amplifies both potential gains and losses, making price swings more pronounced in margin or CFD trading.

Q: Why do crypto prices move overnight or on weekends?

A: Crypto markets operate 24/7, so events outside regular business hours can still impact prices and create gaps.

Q: Is crypto volatility the same as risk?

A: Not exactly. Volatility reflects how much prices fluctuate, while risk relates to the potential for losses.

Q: Can understanding volatility help me trade better?

A: Yes. Knowing the factors that drive volatility allows traders to plan positions and manage risk more effectively.

Related Articles

- Crypto Trading Basics: Spot vs CFD and Blockchain Explained

- Crypto CFD Mechanics: How Trading and Leverage Work

- Crypto Risk & Safety: Understanding Trading Risks, Profitability, and Safety Tips

Next Steps

Want to learn more?

To learn how to manage risk, protect your capital, and trade more safely, read our next guide.