CFD trading, or Contracts for Difference trading, is where you trade on price movements without owning the underlying asset. CFDs are popular because they allow small investors to access markets without buying the full asset.

Understanding key terms like pips, lots, and spreads is essential for calculating your trade size, potential profits, and costs. In this guide, we’ll break down the basics and give you clear examples so you can start trading CFDs with confidence.

What a CFD Is and How It Works

A CFD is a financial derivative that allows you to speculate on the price movement of an asset like stocks, forex, commodities, or cryptocurrencies without actually owning it.

- How it works: You agree to exchange the difference in the asset’s price between the time you open and close the trade.

- Key benefit: You can profit from both rising and falling markets.

Example – Going long (buying):

If you buy a CFD on gold at $1,900 per ounce and sell it later at $1,950, the difference of $50 per unit is your profit (minus fees).

Example – Going short (selling):

If you sell a CFD on Apple at $150 and the price falls to $140, you make $10 per unit. This is called “going short,” allowing you to profit from falling prices, which is something you can’t do if you actually own the stock.

Tip: CFDs let you trade multiple markets from one platform, which makes them versatile for beginners and experienced traders alike.

Understanding Pips, Lots, and Spreads

Pips = The Smallest Price Movement

A pip (percentage in point) is the smallest unit of price movement in a market. For most forex pairs, 1 pip = 0.0001 of the currency pair.

Example: If EUR/USD moves from 1.1000 to 1.1005, that’s 5 pips.

Pips vary by market: in commodities like gold, the smallest move may be 0.01. Understanding this helps you calculate profits or losses accurately.

Lots = Your Trade Size

A lot is the standardized quantity of the asset you are trading.

Common sizes:

- Standard lot = 100,000 units

- Mini lot = 10,000 units

- Micro lot = 1,000 units

Trade size affects potential profit and loss, so larger lots magnify both gains and risks.

Spreads = The Cost Of Trading

The spread is the difference between the buy (ask) and sell (bid) price.

Example: If EUR/USD bid = 1.1000 and ask = 1.1002, the spread is 2 pips.

Why it matters: You start your trade slightly “in the red” because of the spread. Narrower spreads reduce costs.

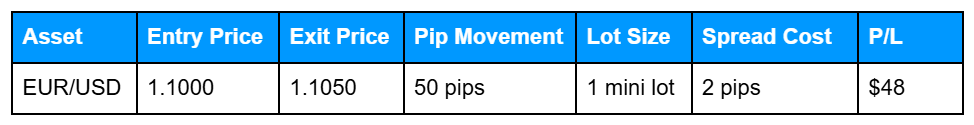

Trade Example: How Pips, Lots, and Spreads Affect Your Trade

Here’s a simple CFD trade showing how entry and exit prices, pip movement, lot size, and spread affect profit or loss.

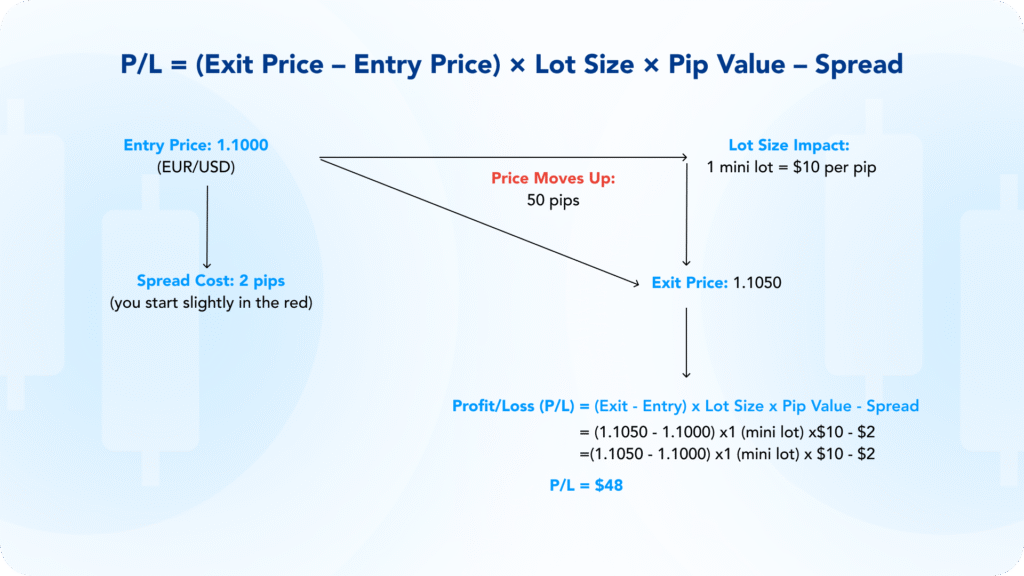

This diagram helps you visualize the relationship between pips, lots and spreads:

Common Beginner Mistakes in CFD Trading

- Confusing CFDs with owning the asset. CFDs do not give you ownership rights.

- Ignoring the spread (small costs can add up over many trades).

- Trading too large lots relative to your account size.

- Assuming leverage is free money (it magnifies both gains and losses).

- Believing past price movements guarantee future results.

Tip: Start small, track your trades, and gradually scale as you understand the mechanics.

Key Risks to Know Before Trading CFDs

- Leverage magnifies losses: Even a small market move against you can result in significant losses.

- Market volatility: Prices can swing quickly, especially in crypto or commodities.

- Platform/account risks: Make sure your broker is regulated and reputable.

Example scenario:

Imagine you open a large CFD on a volatile cryptocurrency without a stop-loss. A sudden price swing could wipe out a significant portion of your account within minutes. Visualizing this risk helps you understand why proper risk management matters.

Tip: Always set stop-losses to manage risk and protect your capital.

Using MT4/MT5 for Your CFD Trades

Most CFD brokers offer MT4 or MT5, which let you:

- Open/close trades quickly

- Monitor pip movements in real-time

- Calculate potential P/L based on lot size and spreads

Tip: Try a demo account first to get familiar with the interface and calculations before trading live.

Frequently Asked Questions About CFDs

Q: Can I lose more than my deposit with CFDs?

A: With proper risk management and stop-losses, you can limit losses to your account balance.

Q: Do I own the underlying asset when trading a CFD?

A: No. You only speculate on the price movement.

Q: Do I need a big account to trade CFDs?

A: Small accounts are fine if you manage lot sizes carefully and use risk controls.

Q: How do I calculate potential profit or loss?

A: Multiply pip movement × lot size × pip value. Your platform usually calculates this automatically.

Related Articles and Further Reading

- Leverage, Margin & Slippage: How They Affect Your CFD Trades

- Trading Risks & Safety: Why Traders Lose and How to Protect Your Capital

- Risk-to-Reward Ratios & Practical Strategies: Applying Risk Management in Real Trades

Next Steps

Want to learn more?

Find out how leverage works and why margin matters in our article on CFD mechanics.