Leverage lets you control larger positions with less capital, but it magnifies both profits and losses. Margin is the amount you need to open a trade, and slippage shows how price can change between order placement and execution. In this guide, we’ll break down these essential mechanics with simple examples so you can trade CFDs confidently and avoid common pitfalls.

How Leverage Lets You Control Bigger Trades

Leverage allows you to control a larger trade than your account balance would normally allow. This means even small price movements can have a big impact on your profit or loss, making it essential to understand before trading.

Example:

- 1:10 leverage: $100 margin controls a $1,000 trade

- 1:100 leverage: $100 margin controls a $10,000 trade

Tip: Higher leverage increases both potential profits and potential losses. Always choose leverage that matches your risk tolerance.

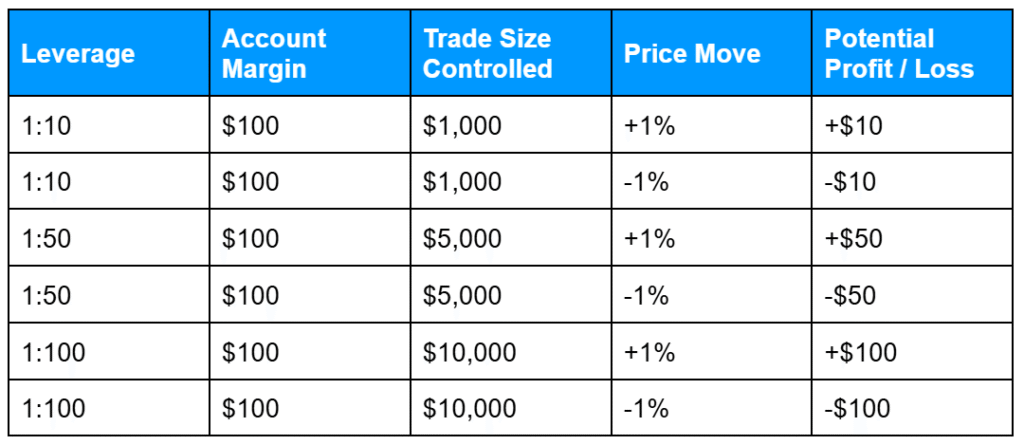

Trade Example: How Leverage Affects Potential P/L

Explanation:

- The same $100 margin can control very different trade sizes depending on leverage.

- Higher leverage amplifies both profits and losses, so even small price moves have a bigger impact.

- This table makes it clear why risk management is essential before choosing a leverage ratio.

How Margin Works and When a Margin Call Happens

Margin is the minimum deposit required to open a CFD position. Your broker monitors your account, and if your losses push your balance below the required margin, a margin call occurs, which may force positions to close automatically.

Formula: Margin = Trade Size / leverage

Example:

- Trade size: $10,000

- Leverage: 1:50 → Margin required: $200

- Account balance drops below $200 → broker issues a margin call

Tip: Keep extra funds in your account to avoid automatic position closure.

Why it matters: Even if your trade is profitable, ignoring margin requirements can lead to sudden closures. Understanding margin helps you manage risk and trade more confidently.

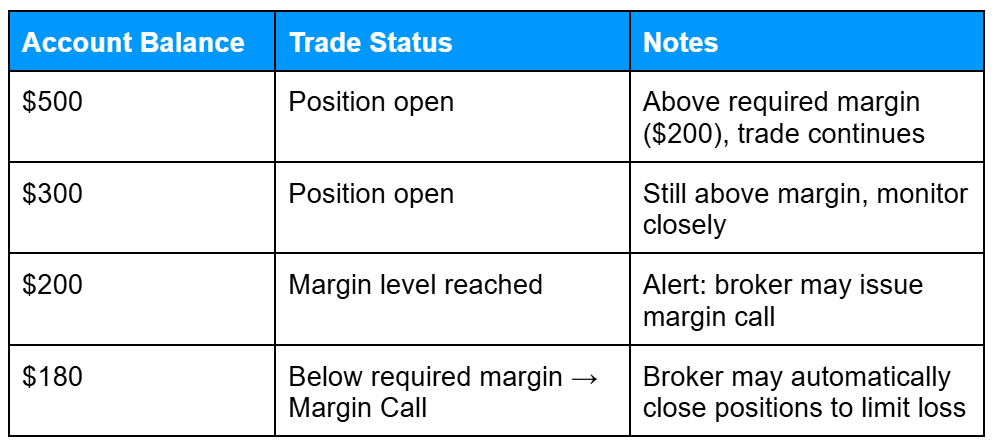

Margin Example: Account Balance vs Margin Requirement

Explanation:

- The margin requirement ($200) is the minimum balance needed to keep the trade open.

- As losses reduce your account balance toward this level, the broker issues a margin call to protect against further losses.

- Keeping extra funds in your account above the required margin reduces the chance of automatic closure.

Tip: Think of margin like a security deposit. You need to maintain enough in your account to “cover” the trade.

What Slippage Is and How It Can Affect Your Trade

Slippage happens when the execution price of your trade differs from the price you requested. This usually occurs in fast-moving markets or during low liquidity periods.

Example:

- You place a buy order at 1.1050

- Market moves quickly → your order executes at 1.1052

- 2-pip slippage increases your trade cost

Tip: Use limit orders if you want to control entry price, but understand they might not execute immediately.

Why it matters: Even small slippage can eat into profits if you trade frequently or with high leverage. Being aware of slippage helps you plan better trade entries and exits.

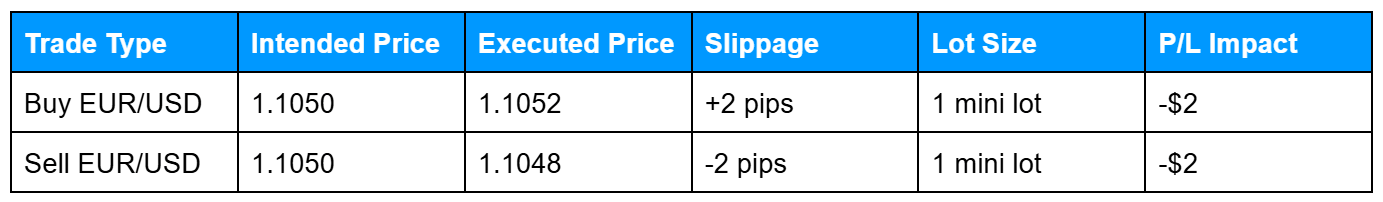

Slippage Example: Intended vs Executed Price

Explanation:

- Intended Price: The price you place your order at.

- Executed Price: The price your trade actually goes through at.

- Slippage: Difference between intended and executed price.

- P/L Impact: How much the slippage costs or benefits you on this trade size.

Tip: Even small slippage can accumulate, especially with frequent trades or high leverage. Using limit orders can help control entry prices, but may reduce execution speed.

Common Beginner Mistakes to Avoid

Even experienced traders can slip up when using leverage, margin, or trading in fast-moving markets.

Common mistakes include:

- Over-leveraging without understanding risk: Using very high leverage can turn small market moves into large losses. Start small and increase leverage only as you gain confidence.

- Ignoring margin requirements → margin calls: Forgetting to monitor your margin can trigger automatic position closures, even on trades that were initially profitable.

- Assuming slippage won’t occur in volatile markets: Fast markets can move prices between the time you place an order and when it executes. Plan for it.

Tip: Begin with low leverage, small positions, and demo accounts to build familiarity safely.

Key Risks to Keep in Mind

Understanding risks helps you trade more confidently:

- Leverage amplifies both gains and losses: Big wins are possible, but losses can be just as fast.

- Margin calls can force position closure: Always maintain sufficient funds to cover margin requirements.

- Slippage can unexpectedly increase losses: Especially during news events or low liquidity periods, prices can move against you.

Tip: Check your platform for real-time margin and exposure monitoring to avoid surprises.

Using MT4/MT5 to Manage Leverage, Margin, and Slippage

Most brokers provide MT4 or MT5, which help you:

- Set leverage for trades and see its effect on potential P/L

- Monitor margin levels in real-time

- Track executed vs requested prices to spot slippage

Tip: Use a demo account to see how leverage, margin, and slippage affect trades before going live.

Related Articles and Further Reading

- What is a CFD? Understanding Pips, Lots & Spreads

- Trading Risks & Safety: Why Traders Lose and How to Protect Your Capital

- Risk-to-Reward Ratios & Practical Strategies: Applying Risk Management in Real Trades

Frequently Asked Questions About CFDs

Q: Can I lose more than my account with leverage?

A: Yes, leverage amplifies both profits and losses. Risk management tools like stop-loss orders can limit exposure.

Q: How do I calculate margin for a trade?

A: Margin = Trade Size ÷ Leverage. Your broker usually calculates this automatically.

Q: How can I reduce slippage?

A: Use limit orders or trade during high liquidity periods.

Next Steps

Want to learn more?

Find out about common trading risks and why traders lose in our related blog.