What Is Stock CFD Trading?

A stock Contract for Difference (CFD) is an agreement between a trader and a broker to exchange the difference in the price of a stock between when a position is opened and when it is closed. Instead of owning the underlying shares, the trader takes a position that reflects the stock’s price movement.

Stock CFDs allow you to take either long or short positions. This means you can speculate on a stock’s price rising (going long) or falling (going short) without buying or selling the actual shares.

Because CFDs do not involve ownership, traders do not receive shareholder rights such as voting or direct dividends. However, CFDs can offer access to multiple stocks and global markets with a smaller upfront capital outlay compared with buying shares outright.

How Do Stock CFDs Work?

Once you understand what a stock CFD represents, the trading process itself is straightforward.

To trade a stock CFD, you choose a stock and decide whether to go long if you expect the price to rise, or short if you expect it to fall. Your position tracks the stock’s price movement, even though you do not own the underlying shares.

Profit or loss is calculated based on the difference between your entry and exit prices, multiplied by the number of CFD units traded. CFDs use margin and leverage, meaning a relatively small initial deposit can control a larger position, which also increases potential gains and losses.

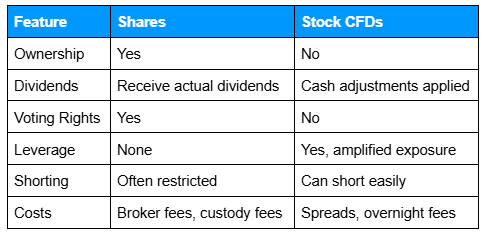

What’s the Difference Between Shares and Stock CFDs?

Trading stock CFDs is different from owning shares in several important ways. Understanding these differences is essential for making informed trading decisions.

Ownership

- Shares: Provide legal ownership of the company, including voting rights and entitlement to dividends.

- CFDs: Do not confer ownership of the underlying stock. Traders do not receive voting rights, and any dividend adjustments are applied as cash adjustments to the CFD position.

Capital Requirements

- Shares: You must pay the full purchase price upfront to acquire the stock.

- CFDs: Only a margin deposit is required, allowing you to gain exposure with less initial capital.

Ability to Short

- Shares: Short-selling may be restricted or require borrowing shares.

- CFDs: Shorting is straightforward; you can open a sell position to profit from a falling stock price without owning the shares.

Costs and Holding Considerations

- Shares: Costs typically include brokerage fees and, in some cases, custody fees.

- CFDs: Costs include spreads and overnight financing fees, which can accumulate if positions are held over multiple days.

Risk Profile

- Shares: Risk is generally limited to the amount invested in purchasing the stock.

- CFDs: Leverage amplifies both gains and losses. It is possible to lose more than the initial margin deposit if the market moves against your position.

The table below summarises the key differences between shares and stock CFDs.

Alt text: Table outlining the main distinctions between owning shares and trading stock CFDs, including ownership, dividend treatment, voting rights, leverage availability, shorting ability, and associated costs.

Benefits and Limitations of Stock CFDs

Trading stock CFDs offers flexibility, but it also involves specific risks and costs. Understanding both sides helps traders make informed decisions.

Benefits of Stock CFDs

- Flexibility to trade long or short: You can take positions based on whether you expect a stock’s price to rise or fall.

- Lower upfront capital requirement: Only a margin deposit is needed to gain exposure, which can be smaller than purchasing the shares outright.

- Access to global stock markets: CFDs allow exposure to a wide range of international stocks that might otherwise require significant investment.

Limitations of Stock CFDs

- Leverage amplifies potential losses: While leverage can increase exposure, it also increases the potential for losses beyond the initial deposit.

- No ownership rights: CFD traders do not have voting rights, and dividends are handled as cash adjustments.

- Costs for holding positions overnight: Spreads and overnight financing fees can accumulate if positions are held for multiple days

Before trading stock CFDs, it’s worth considering the following:

- Can I manage amplified gains and losses due to leverage?

- Am I aware that I do not own the underlying shares?

- Have I factored in overnight holding costs?

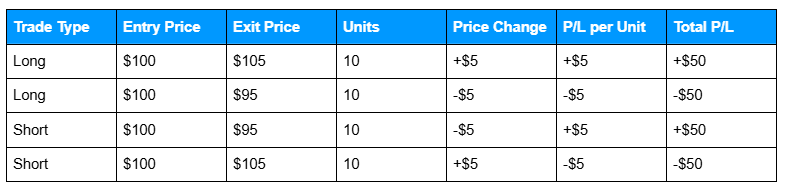

Practical Examples of Stock CFD Trades

The examples below are for illustration only and do not reflect actual market conditions.

1. Long CFD Trade (Buy Position)

- You open a long CFD on a stock at $100 per share, taking 10 units.

- If the stock price rises to $105, the position reflects a $5 increase per unit, multiplied by 10 units.

- If the stock price falls to $95, the position reflects a $5 decrease per unit.

In this example, your exposure is larger than the initial deposit because of margin, so both gains and losses are amplified.

2. Short CFD Trade (Sell Position)

- You open a short CFD on the same stock at $100 per share, taking 10 units.

- If the stock price falls to $95, the position reflects a $5 gain per unit, multiplied by 10 units.

- If the stock price rises to $105, the position reflects a $5 loss per unit.

In this example, short positions allow you to potentially benefit from falling prices, but losses can also be magnified due to leverage.

Here’s a quick illustration showing how profits and losses can work for long and short CFD trades:

Alt text: Table showing example long and short CFD trades, including entry and exit prices, number of units, price change per unit, P/L per unit, and total profit or loss.

Note: This example shows how gains and losses can be amplified due to leverage. Real trading outcomes may differ, and losses can exceed your initial margin deposit. Always manage your risk carefully.

Long positions profit when prices rise, short positions profit when prices fall, but leverage amplifies both gains and losses.

Common Misconceptions About Stock CFDs

1. “CFDs are the same as owning shares.”

CFDs track the price movement of a stock but do not provide ownership. You do not receive voting rights, and dividends are typically reflected through cash adjustments rather than direct payments.

2. “Leverage guarantees higher profits.”

Leverage increases exposure, which amplifies both gains and losses. Outcomes depend on market movement, making risk management an important part of trading leveraged positions.

3. “CFDs are only for short-term traders.”

CFDs can be used for both short- and longer-term strategies. However, holding positions over time may involve additional costs such as overnight financing fees.

Frequently Asked Questions

Q: What is stock CFD trading?

A: Stock CFD trading lets you speculate on share price movements without owning the underlying stock. A CFD is an agreement to exchange the difference in price between when the trade is opened and closed.

Q: How do stock CFDs work?

A: You can go long if you expect the price to rise, or short if you expect it to fall. Profit or loss is based on the price difference multiplied by your position size, with leverage amplifying both gains and losses.

Q: What’s the difference between shares and stock CFDs?

A: Shares give you ownership, dividends, and voting rights, while CFDs track price movements without ownership. CFDs require smaller upfront capital, allow short selling easily, and involve costs like spreads and overnight fees.

Q: Can I go short with stock CFDs?

A: Yes, CFDs allow short positions to potentially profit from falling prices. This is simpler than shorting shares directly, which may be restricted.

Q: What are the risks of trading stock CFDs?

A: Leverage can amplify both gains and losses. Other risks include market volatility, overnight fees, and potential slippage.

Q: Do I receive dividends when trading stock CFDs?

A: You don’t own the shares, but CFDs typically adjust your account for dividends. Long positions may receive a cash adjustment, while short positions are debited.

Related Articles

- Stock CFD Mechanics: What Affects Prices and How to Start Trading

Next Steps

Want to learn more?

Find out what affects stock prices in our article on stock CFD mechanics.