What Affects Stock CFD Prices?

Stock CFD prices move in line with the underlying shares, which can fluctuate for a variety of reasons. Understanding these factors helps you anticipate potential market movements.

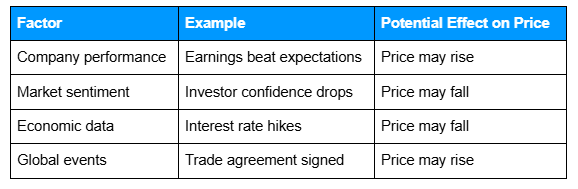

Key Factors Affecting Stock Prices:

- Company performance: Earnings reports, management changes, product launches

- Market sentiment: Investor confidence, broader market trends, social sentiment

- Economic data: Interest rates, GDP growth, inflation, unemployment

- Global events: Political developments, international trade, macroeconomic shocks

Here’s a quick overview of how these factors can influence prices:

Alt text: Table showing how different factors influence stock CFD prices, including company performance, market sentiment, economic data, and global events, with potential effects on price.

How Do I Start Trading Stock CFDs?

Getting started with stock CFDs doesn’t have to be complicated. You can follow a simple sequence to open your first position while keeping risk and capital in mind.

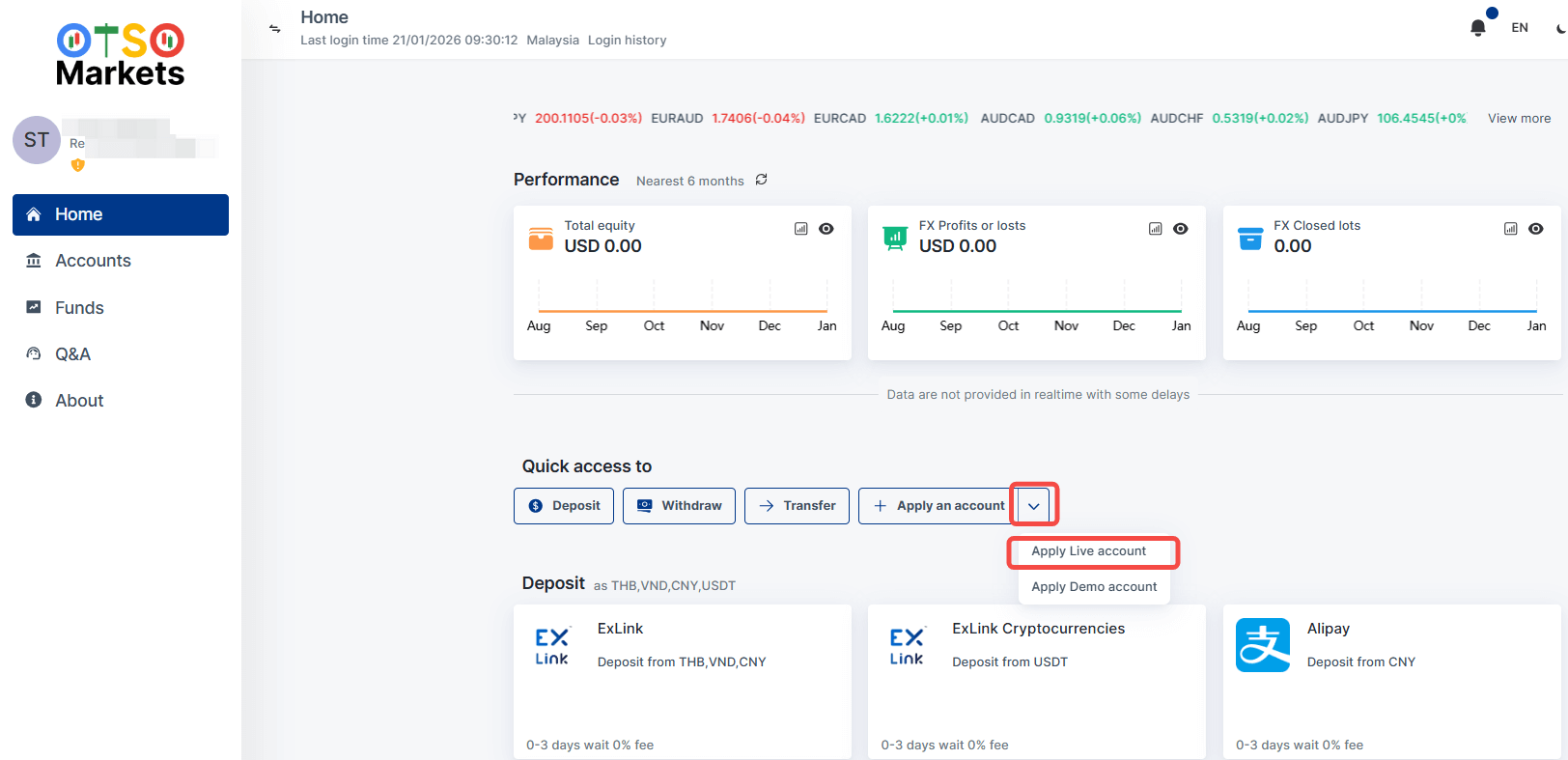

Start your journey through the OTSO Markets platform:

Alt text: Screenshot of the OTSO Markets trading platform showing how to get quick access to applying for a live account.

1. Open a CFD trading account

Complete your identity verification and fund your account to get started.

2. Pick your stock CFD

Look at the stock’s market exposure and how volatile it tends to be.

3. Choose your position type

You could go long (buy) if you expect the price to rise, or short (sell) if you expect it to fall.

4. Decide on trade size and margin

Consider your available capital and the leverage limits of your account.

5. Place the trade

Enter the number of units and price. Setting stop-loss or take-profit levels can help manage risk.

6. Monitor your position

Keep an eye on market movements and adjust your stops or limits if needed.

Following these steps gives you a practical and structured way to begin trading stock CFDs, while staying aware of potential risks.

Can You Trade Stock CFDs With a Small Account?

Even if your account balance is small, margin allows you to control positions larger than your initial capital.

Considerations and risks for small accounts:

- Leverage amplifies both gains and losses.

- Overnight holding costs can accumulate.

- There’s a risk of margin calls if the market moves against your position.

Tips for managing small accounts:

- Start with smaller positions.

- Practice on a demo account.

- Plan risk and exposure carefully.

By being cautious and disciplined, small accounts can trade effectively while learning the mechanics of CFDs.

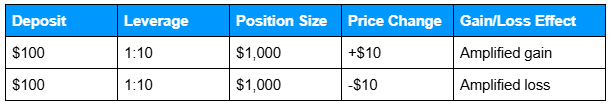

What Is Leverage in Stock CFD Trading?

Leverage allows you to control a position larger than your initial deposit. For example, with 1:10 leverage, a $100 deposit gives you exposure to a $1,000 position.

While leverage can amplify potential gains, it also increases potential losses. Using smaller positions and stop-loss orders can help manage risk.

Here’s a simple illustration of leverage impact:

Alt text: Table showing how different leverage levels affect a CFD trade, with a $100 deposit controlling a $1,000 position, and how a $10 price change results in amplified gain or loss.

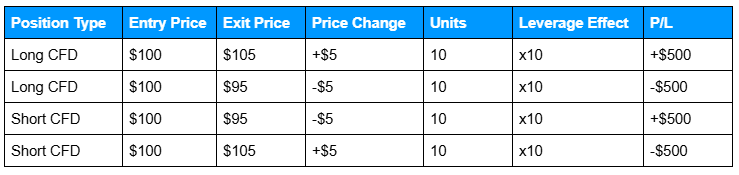

Examples of Leveraged Stock CFD Trades

To see how leverage affects a trade, consider these hypothetical examples:

Long Position (Buy CFD)

- Entry: $100 per share, 10 units, leverage 1:10

- Price rises to $105 → $5 increase per unit × 10 units = $50 gain

- Price falls to $95 → $5 decrease per unit × 10 units = $50 loss

Short Position (Sell CFD)

- Entry: $100 per share, 10 units, leverage 1:10

- Price falls to $95 → $5 gain per unit × 10 units = $50 gain

- Price rises to $105 → $5 loss per unit × 10 units = $50 loss

Both examples show that leverage amplifies the impact of price movements, increasing both potential gains and potential losses.

Here’s a quick example of how a small initial deposit, combined with leverage, can significantly magnify gains or losses while trading stock CFDs.

Alt text: Table showing example long and short stock CFD trades with a small deposit, illustrating how a 10x leverage amplifies gains or losses based on price changes, units traded, and resulting P/L.

Common Mistakes to Avoid When Trading Stock CFDs

Even experienced traders can make mistakes when trading stock CFDs. Being aware of common pitfalls can help you manage risk and trade more effectively.

Over-leveraging small accounts

Using too much leverage can amplify losses, especially in smaller accounts. Start with modest positions and only risk what you can manage.

Ignoring overnight fees and margin calls

Holding positions overnight can incur financing fees, and insufficient margin can trigger a margin call. Always check costs and account requirements before trading.

Not understanding market drivers

Trading without knowing what moves the stock or index can lead to unexpected losses. Research key factors like earnings reports, economic data, and market sentiment.

Trading emotionally without a plan

Making impulsive decisions often results in poor outcomes. Set clear strategies, stop-losses, and profit targets before entering trades.

Frequently Asked Questions

Q: What factors influence stock CFD prices?

A: Stock CFD prices follow the underlying shares, which can be affected by company earnings, market sentiment, economic indicators, and global events. Knowing these drivers helps you anticipate price movements before trading.

Q: How does leverage affect stock CFD trades?

A: Leverage lets you control a larger position with a smaller deposit, magnifying both potential gains and losses. Using stop-losses and smaller positions can help manage this risk.

Q: Can I start trading stock CFDs with a small account?

A: Yes, margin allows smaller accounts to access positions larger than their deposit. Careful planning is needed to manage leverage, overnight costs, and potential margin calls.

Q: What are the main risks when trading stock CFDs?

A: Key risks include amplified losses due to leverage, volatility in the underlying stock, overnight fees, and possible slippage. Understanding price drivers can help manage these risks effectively.

Q: How do short positions work in stock CFDs?

A: Short positions allow you to potentially profit when a stock falls in price, even if you don’t own the shares. Gains and losses are still affected by leverage and market movements.

Related Articles

Next Steps

Want to learn more?

Find out how stock CFD trading works in our stock trading and key concepts primer.