How Gold Trading Works

Gold trading can take several forms, from owning the physical metal to speculating through derivatives such as CFDs or ETFs. Understanding these options helps traders and investors choose the approach that best aligns with their goals.

Physical vs CFD Trading

Physical Gold: Involves direct ownership of the metal, requiring secure storage and insurance. This approach is typically used for long-term investment or portfolio hedging.

Gold CFDs: Track the price of gold without ownership of the underlying asset. CFDs allow traders to use leverage, meaning a relatively small deposit can control a larger position. While leverage can amplify gains, it also increases potential losses, so margin requirements and risk management should be carefully considered.

Reasons to Trade Gold

Traders and investors engage with gold for several key objectives:

- Hedging: Protect portfolios against inflation or currency fluctuations. For example, a trader might open a long gold CFD to offset potential losses in a currency-sensitive portfolio.

- Safe Haven: Gold often retains value during economic uncertainty. Traders may increase CFD positions during market stress to help stabilize their portfolios, though prices can still fluctuate.

- Speculation: Take positions on short-term price movements via gold CFDs or ETFs. Leverage allows larger exposure, but small market moves can create significant gains or losses.

Market Characteristics

Gold markets are highly liquid, and gold CFDs typically trade nearly 24 hours a day. Prices are influenced by economic data, geopolitical events, central bank policies, and USD fluctuations.

Gold is often used as an inflation hedge, and historical volatility shows moderate swings compared to other commodities. Staying informed about these factors helps traders make more informed decisions when trading gold CFDs.

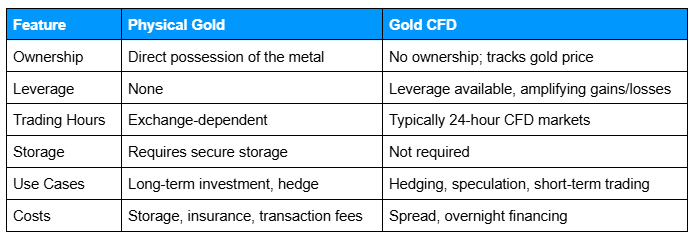

Gold can be accessed in different ways, each with unique considerations for traders and investors. The table below summarizes the key differences between owning physical gold and trading gold CFDs:

Alt text: Table comparing physical gold and gold CFDs across ownership, leverage, trading hours, storage, use cases, and costs.

How Silver Trading Works

Silver trading shares similarities with gold but also has unique market characteristics that can influence trading decisions. Understanding these differences helps traders and investors choose the approach that aligns with their goals.

Physical vs CFD Trading

Physical Silver: Involves direct ownership of the metal, requiring secure storage and insurance. This approach is generally used for long-term investment or portfolio diversification.

Silver CFDs: Track the price of silver without ownership of the underlying asset. CFDs allow traders to use leverage, enabling a smaller deposit to control a larger position. While leverage can amplify gains, it also increases potential losses, so careful consideration of margin requirements and risk management is essential.

Reasons to Trade Silver

Traders and investors engage with silver for several key objectives:

- Diversification: Gain exposure to an additional asset class. For example, adding silver CFDs to a stock-heavy portfolio can help spread risk across different investments.

- Industrial Demand: Silver’s dual role as a commodity and investment creates unique price dynamics. Traders may open long silver CFDs anticipating higher industrial demand.

- Speculation: Take advantage of short-term price movements via silver CFDs or ETFs. Leverage allows larger exposure, but small market moves can create significant gains or losses.

Market Characteristics

Silver markets are smaller and often more volatile than gold, partly due to lower liquidity and strong industrial demand. Prices respond to economic cycles, investor sentiment, USD movements, and industrial trends.

While silver can provide diversification and speculative opportunities, traders using silver CFDs should closely monitor market news and manage risk carefully. Historical volatility is generally higher than gold, so timely decision-making is crucial.

Below is a comparison of key characteristics between gold and silver trading to help illustrate their similarities and differences:

Alt text: Table comparing gold and silver markets, including market size, volatility, ownership options, leverage, risk level, and typical trading use cases.

Why Do People Trade Gold and Silver?

Traders and investors engage with gold and silver for several key reasons, each offering different opportunities depending on their goals and risk tolerance.

Hedging

Precious metals can help protect portfolios against economic or currency fluctuations.

Example: A trader opens a long gold CFD to offset potential losses in a currency-sensitive portfolio. Leverage can amplify both gains and losses, so careful risk management is essential.

Diversification

Including gold or silver in a portfolio spreads risk across different asset classes.

Example: Adding a small allocation of silver CFDs to a portfolio of stocks and bonds can help reduce the impact of stock market volatility. Traders may also use gold CFDs for further portfolio balance.

Safe Haven

Gold is often viewed as a store of value during times of economic uncertainty.

Example: During periods of market stress, investors might increase gold CFD positions to maintain portfolio stability. While gold can act as a buffer, prices can still fluctuate, so monitoring risk is important.

Speculation

Traders can take short-term positions on price movements to seek profits using CFDs or ETFs.

Example: A trader opens a short silver CFD in response to declining industrial demand, while another trader may take a long gold CFD position using leverage during volatile market conditions. Small price movements can lead to larger gains or losses, so leverage should be used carefully within one’s risk tolerance.

Frequently Asked Questions

Q: Does gold always rise in value?

A: No. Gold prices fluctuate with macroeconomic conditions, including interest rates, inflation expectations, and currency movements. While often viewed as a store of value, gold can decline during certain periods.

Q: Do CFDs eliminate trading risk?

A: No. CFDs are leveraged products that allow traders to gain exposure without owning the metal, but leverage amplifies both gains and losses. Effective risk management is essential when trading gold or silver CFDs.

Q: Does silver behave the same as gold?

A: Not exactly. Silver shares some price drivers with gold but is more sensitive to industrial demand. Its smaller market size and lower liquidity can result in higher volatility and sharper short-term price movements.

Q: Can hedging protect me from all losses?

A: No. Hedging can reduce exposure to certain risks but cannot guarantee protection. Market conditions can change quickly, and hedging strategies may not always perform as expected.

Q: Can I own physical gold while trading CFDs?

A: Yes. Some traders hold physical gold for long-term investment while using CFDs for short-term speculation.

Q: What factors affect gold and silver prices?

A: Prices respond to economic data, geopolitical events, central bank policies, industrial demand (especially for silver), and investor sentiment.

Q: Are precious metals CFDs suitable for all traders?

A: CFDs involve leverage and risk and may not be suitable for traders with low risk tolerance or limited experience.

Q: What other precious metals can be traded besides gold and silver?

A: Platinum and palladium are also traded globally. However, gold and silver remain the most liquid and widely followed, making them the most common entry points for new precious metals traders.

Related Articles

Next Steps

Want to learn more?

Find out what drives gold and silver prices in our article on precious metals trading mechanics.