What Is an Index?

An index measures the performance of a group of stocks, representing a portion of the market. Examples include the S&P 500, FTSE 100, and NASDAQ 100. Indices are usually weighted by market capitalization or price, meaning that stocks with larger market value or higher prices have a bigger influence on the overall index.

Understanding how indices are constructed is important before trading CFDs, because the composition affects how your position moves in response to market events.

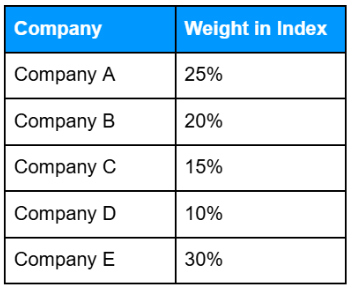

For example, looking at which companies are included in an index and their relative weights can help you anticipate how the index might react to price changes:

Alt text: Table listing companies in a stock index with their respective weights, helping to illustrate how changes in individual stock prices may influence the overall index performance.

Companies with a larger weight in the index have a greater effect on the index’s overall movement, so price changes in these companies move the index more than changes in smaller-weighted companies.

How Does Index Trading Work?

Index CFDs let you speculate on the price movements of an index without owning the underlying stocks. You can take a long position if you expect the index to rise, or a short position if you expect it to fall.

Using leverage and margin, a relatively small deposit can control a larger position, amplifying both potential gains and losses. Trading hours may differ from the underlying stock markets, especially for global indices, so it’s important to check market opening and closing times.

Step-by-Step Example Trade

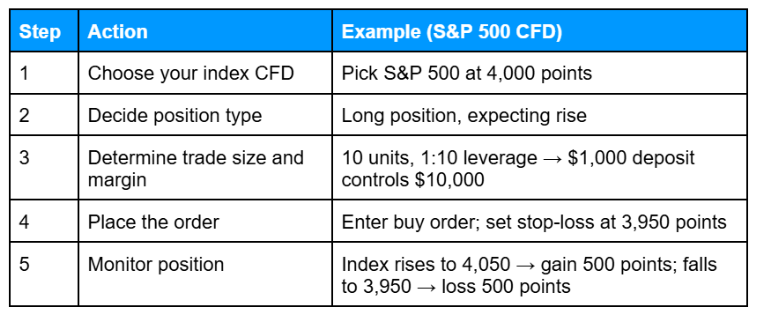

Here’s a step-by-step example to illustrate how a CFD position mirrors index movements and how leverage can amplify gains or losses.

Alt text: Table outlining each step in trading an S&P 500 CFD, including choosing the CFD, deciding position type, calculating trade size and margin, placing the order, and monitoring the position to see how leverage amplifies gains or losses.

This example demonstrates how your CFD position mirrors the index and how leverage amplifies both gains and losses.

Index CFDs vs Trading Individual Stocks

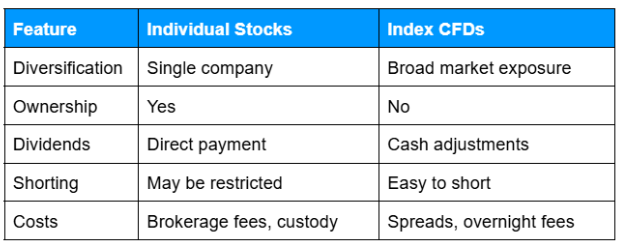

Trading an index CFD differs from buying individual shares in several key ways:

Diversification

An index reflects the performance of a group of stocks, giving broad market exposure in a single position. Individual stocks provide concentrated exposure to a single company, which carries higher risk.

Ownership

When trading CFDs, whether on an index or a stock, you do not own the underlying assets. There are no voting rights, and dividends are typically applied as cash adjustments.

Costs and holding considerations

Trading index CFDs involves spreads and may include overnight financing fees if positions are held across multiple days.

Flexibility

Shorting an index CFD is straightforward, allowing you to potentially profit from a falling market without the need to short multiple individual stocks separately.

Here’s a quick comparison to illustrate the differences:

Alt text: Table illustrating the main differences between trading individual stocks and index CFDs, including diversification, ownership, dividend treatment, shorting rules, and associated costs.

Common Mistakes and Misconceptions

Even though index CFDs offer broad market exposure, beginners often make avoidable mistakes:

Treating index CFDs like guaranteed returns

Gains are never assured. As with all CFDs, leverage can amplify both profits and losses.

Ignoring leverage and margin impact

Using leverage increases exposure, which can magnify potential losses if the market moves against you.

Assuming diversification removes all risk

Spreading risk across an index does not eliminate it. Market-wide events can still affect the entire index.

Trading without understanding the index composition

Knowing which stocks make up an index helps anticipate potential price movements and sector-specific risks.

Frequently Asked Questions

Q: What is an index CFD?

A: An index CFD is a derivative that tracks the price of a market index. It lets you speculate on the overall market movement without owning the underlying stocks.

Q: Can I go short with an index CFD?

A: Yes. You can open a sell position to potentially profit from a falling index, similar to going long if you expect it to rise.

Q: How does leverage affect index CFD trading?

A: Leverage allows you to control a larger position than your deposit, amplifying both potential gains and losses.

Q: Are index CFDs less risky than individual stocks?

A: They offer diversification, which can reduce company-specific risk, but they are still exposed to market-wide events and leverage-related risks.

Related Articles

Next Steps

Want to learn more?

Find out what moves index prices in our article on index CFD mechanics.