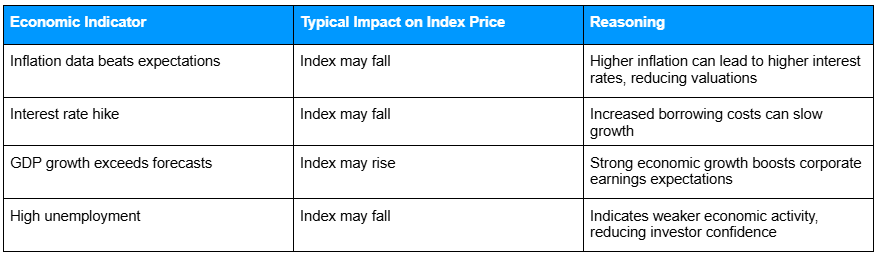

What Affects Index Prices?

Several factors influence the value of an index, often interacting with each other:

- Economic Indicators: Reports on inflation, interest rates, GDP growth, and employment data can shift market expectations and move indices.

- Company Earnings: Especially for heavily weighted constituents, earnings surprises or guidance can significantly impact the index.

- Market Sentiment: Investor confidence, media coverage, and geopolitical news influence buying and selling behavior.

- Liquidity and Market Structure: Trading volume and bid-ask spreads can affect price stability and the speed at which the index moves.

Here’s a snapshot of how key economic indicators typically influence index prices:

Understanding these drivers can help traders anticipate potential index movements and make more informed CFD trading decisions.

Why Index Prices Often Spike at Market Open and Close

Index prices often experience noticeable movements at the start and end of trading sessions due to several factors:

Liquidity bursts

Many orders concentrate around market open and close, amplifying short-term price swings.

Volatility patterns

Gaps or rapid movements may occur as markets react to overnight news or pre-market activity.

Price discovery

Early trading reflects new information being incorporated into prices, while late trading often consolidates positions and adjusts for the day’s developments.

Tip: These predictable volatility patterns can affect short-term CFD trading outcomes and trade execution.

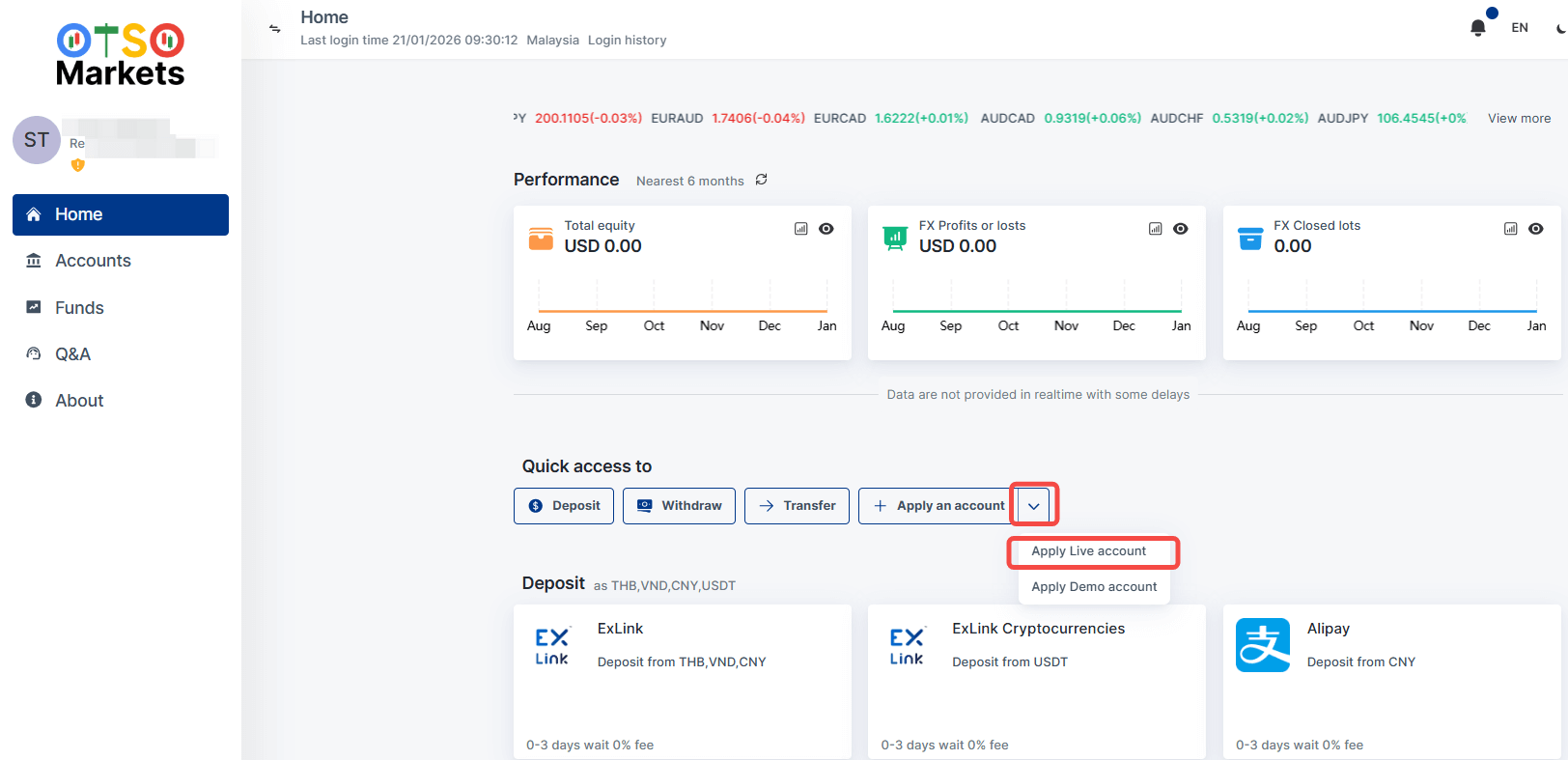

How to Start Trading Index CFDs

Here’s a structured approach to help you begin trading index CFDs with risk awareness in mind. Start your journey through the OTSO Markets platform:

Alt text: Screenshot of the OTSO Markets trading platform showing how to get quick access to applying for a live account.

1. Open a CFD trading account

Complete identity verification and fund your account.

2. Select an index CFD

Consider liquidity, volatility, and the trading hours of the underlying market.

3. Decide your position type

Go long (buy) if you expect the index to rise, or short (sell) if you expect it to fall.

4. Determine trade size and margin

Use available capital and leverage limits to size your position appropriately.

5. Place the order

Enter the number of units and price. Optionally set stop-loss or take-profit levels to manage risk.

6. Monitor and adjust

Track market news and price movements, adjusting your stops, limits, or positions if conditions change.

Following these steps helps you approach index CFD trading in a structured, risk-aware way.

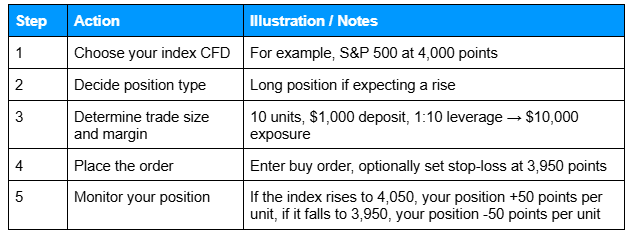

Step-by-Step Example Trade

Let’s see a hypothetical trade to illustrate how an index CFD reacts to market events and leverage:

Alt text: Table outlining a hypothetical S&P 500 index CFD trade, including steps to select the CFD, decide on long position, determine trade size and 1:10 leverage margin, place the order with optional stop-loss, and monitor price changes to see how gains or losses are amplified.

This example shows how the CFD mirrors the index and how leverage amplifies both gains and losses.

Examples of Index Movements

Index prices can react quickly to specific market events. The examples below show how different triggers can influence index CFDs in practice.

Inflation announcement

A higher-than-expected CPI release can pressure equity markets. For example, the S&P 500 may fall as traders reassess interest rate expectations and future corporate earnings.

Earnings season

During earnings season, results from heavily weighted FTSE 100 companies can move the index even if other constituents remain relatively stable.

Volatility at market open and close

Index volatility often increases at the start and end of trading sessions, when new information is priced in and large orders are executed.

Example:

Suppose a trader opens a CFD on the NASDAQ during a high-volume session following a major economic announcement. Using margin, the position tracks the index closely.

- If the index rises after the news is absorbed by the market, the CFD reflects that upward movement.

- If the index falls due to negative sentiment, the CFD mirrors the decline.

This example shows how index CFDs respond directly to market conditions, and how leverage amplifies both potential gains and potential losses. All figures are illustrative only.

Common Mistakes and Misconceptions

Understanding what moves index prices is only part of the picture. Applying that knowledge in real trading situations requires careful planning and realistic expectations, especially when leverage and volatility are involved.

Believing index CFDs remove risk due to diversification

Diversification spreads exposure across multiple stocks but does not eliminate risk. Broad market events can still move an entire index in the same direction.

Ignoring leverage and margin requirements

Leverage increases exposure to index movements, which can magnify losses as quickly as gains. Not accounting for margin requirements can result in unexpected margin calls.

Trading during high-volatility events without planning

Economic announcements and earnings releases can cause sharp index moves. Entering trades without defined position sizing or risk limits increases potential downside.

Misunderstanding why indices move at market open and close

Price spikes often occur when orders cluster and new information is priced in. Recognising these patterns helps set more realistic expectations for short-term trading behaviour.

Taken together, these considerations highlight why understanding index mechanics, market timing, and risk management is essential before trading index CFDs.

Related Articles

Next Steps

Want to learn more?

Find out how index CFDs work in our indices trading and key concepts primer.