What Affects Commodity Prices?

Commodity prices respond directly to changes in real-world production, consumption, and expectations about future availability. Several key factors interact to determine price movements:

Supply and Demand

Production levels, crop yields, and mining output influence how much of a commodity is available. Changes in inventory levels or stockpiles can also shift prices, as scarcity or surplus affects market expectations.

Geopolitical Factors

Trade restrictions, sanctions, conflicts, and OPEC decisions (for oil and energy commodities) can restrict supply and create sudden price swings.

Economic Indicators

Inflation data, interest rate changes, and currency movements can influence commodity prices globally, particularly the strength of the US dollar.

Market Sentiment and Speculation

Trader expectations, positioning, and reactions to forecasts or news can amplify short-term volatility. Speculative activity can sometimes exaggerate price movements beyond what fundamentals suggest.

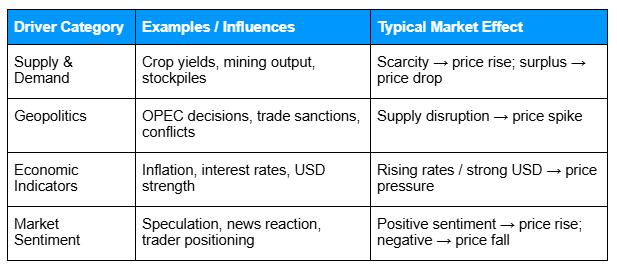

The table below summarizes key factors that commonly influence commodity prices and their typical market effects.

Alt text: Table showing key commodity market driver categories, example influences, and their typical effects on prices, including supply and demand, geopolitics, economic indicators, and market sentiment.

Note: Effects are illustrative, actual market response may vary.

Why Are Commodity Markets Volatile?

Commodity markets often react quickly because supply and demand cannot always adjust immediately to new information. Sudden events can cause sharp price movements, increasing both potential opportunities and risks for your trades.

Common causes of volatility include:

Weather and natural events

Droughts, floods, hurricanes, and other extreme weather events can disrupt agricultural production or energy supply, causing prices to swing.

Geopolitical shocks

Trade restrictions, sanctions, conflicts, or sudden policy changes can limit supply or alter demand, leading to rapid market movements.

Low or uneven liquidity

Some commodities are less actively traded than major stock indices. Thin trading can magnify price changes, even from relatively small orders.

Economic data releases

Reports such as inflation, interest rate decisions, or employment data can shift expectations about future supply and demand, affecting commodity prices quickly.

How Do I Start Trading Commodities?

Trading commodity CFDs follows a similar process to other CFD markets, but it requires extra attention to volatility and contract specifications. Here’s a structured approach emphasizing planning and risk management:

1. Choose a Commodity CFD

Decide which type of commodity to trade: metals (gold, silver), energy (oil, natural gas), or agricultural goods (wheat, coffee). Consider the market hours and liquidity of each commodity.

2. Understand Contract Details

Each commodity CFD has specific contract sizes, tick values, and trading hours. Knowing these details helps you determine your exposure and manage risk effectively.

3. Decide Your Trade Direction

Go long (buy) if you expect the commodity price to rise, or short (sell) if you anticipate a fall. This flexibility allows you to potentially take advantage of both market directions.

4. Set Position Size and Margin

Use your available capital and leverage limits to calculate the right position size. Remember that leverage amplifies both potential gains and losses.

5. Place the Trade

Enter your order, including optional stop-loss or take-profit levels to help manage risk. Planning these levels ahead of time can prevent emotional decision-making during volatile movements.

6. Monitor Your Position

Track market news, supply developments, and volatility. Adjust stops, limits, or overall exposure as needed to stay aligned with your trading plan.

Examples of Commodity Price Movements

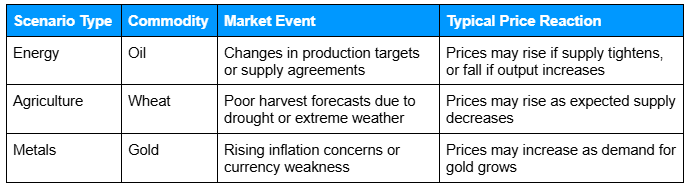

Commodity prices often react quickly to real-world events. The scenarios below illustrate how different factors can influence both the underlying market and a CFD position:

Alt text: Table showing commodity market scenarios, including the type of commodity, specific market events, and typical price reactions for energy, agriculture, and metals.

Example of How a Commodity CFD Responds to Market Changes

- Market scenario: Inflation concerns increase demand for gold as a perceived store of value.

- Price movement: Gold moves from $1,800 to $1,820.

- Trade setup: A trader opens a long CFD position on gold, 10 units with leverage.

- Outcome: If prices rise, the position reflects the $20 price increase, leading to a conceptual gain of $200. If prices fall instead, the CFD mirrors the decline, amplifying losses.

This example shows how commodity CFDs track the underlying market price rather than guaranteeing outcomes. Because leverage magnifies price movements in both directions, careful position sizing and risk management are essential when trading commodities.

Frequently Asked Questions

Q: Do commodity prices always move slowly?

A: No. Many commodities can experience sharp price changes in short periods due to supply disruptions, economic data, or geopolitical events.

Q: Is physical supply the only thing that determines commodity prices?

A: Not entirely. Expectations, market sentiment, and speculation can also drive prices, sometimes more than current supply levels.

Q: Does leverage make commodities easier to trade?

A: Leverage increases potential gains but also amplifies losses. It doesn’t make trading inherently easier and requires careful risk management.

Q: Do all commodities behave the same way?

A: Each commodity market has unique drivers. For example, gold may react to inflation concerns, oil to geopolitical events, and wheat to weather conditions.

Related Articles

Next Steps

Want to learn more?

Find out how commodity CFDs work in our commodities trading and key concepts primer.