What Are Commodities in Trading?

Commodities are raw or primary goods that are widely used in commerce and are traded on exchanges around the world. Understanding the different types of commodities is the first step in trading them effectively.

Common Types of Commodities:

- Metals: Gold, silver, copper — often considered safe-haven or industrial commodities.

- Energy: Oil, natural gas — influenced by supply, demand, and geopolitical events.

- Agriculture: Wheat, corn, coffee — prices can fluctuate with weather, crop reports, and global consumption trends.

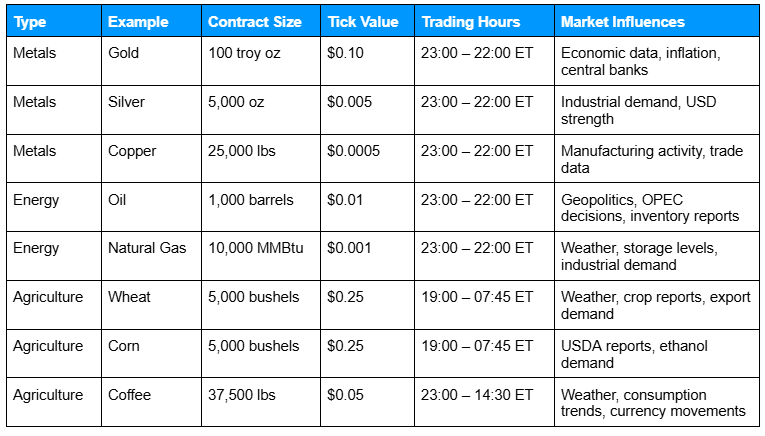

To give a clearer picture of what’s traded and how, here’s a snapshot of common commodities and their typical trading specifications.

Alt text: Table listing CFDs for gold, silver, copper, oil, natural gas, wheat, corn, and coffee, with contract size, tick value, trading hours, and factors that influence their market prices.

Note: Numbers are illustrative; check your broker for exact specifications.

As commodities vary widely in volatility and market drivers, understanding these differences helps manage trading risk.

How Does Commodities Trading Work?

Trading commodities via CFDs involves several core concepts that determine how positions behave, how exposure is calculated, and how profits or losses are realized. Here’s a step-by-step breakdown:

1. CFDs for Commodities

Commodity CFDs track the price of the underlying asset without owning it. Gains or losses reflect the commodity’s price movement, multiplied by your position size.

2. Position Types

Traders can go long (buy) if they expect prices to rise or short (sell) if they expect prices to fall. This flexibility allows you to potentially benefit from both rising and falling markets.

3. Leverage and Margin

Leverage lets a small deposit control a larger position. For example, a $1,000 deposit with 1:10 leverage gives exposure to $10,000 of the commodity. While this can amplify gains, it also magnifies potential losses, making risk management essential.

4. Contract Sizes / Lots

Each CFD has a defined contract size or lot. Knowing the contract specifications ensures you understand your total exposure. For instance, buying one gold CFD contract at $1,800 per ounce for 100 oz means controlling $180,000 of gold with a much smaller margin deposit.

5. Monitoring and Adjusting Positions

Track price movements, news, and market reports. Adjust stop-loss or take-profit levels if market conditions change. Commodity markets can be volatile, so active monitoring helps manage risk.

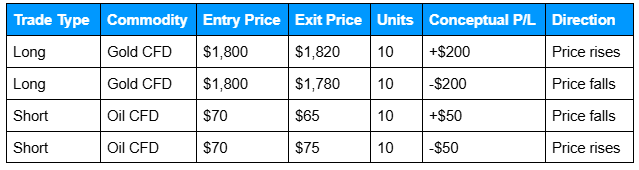

Examples of Commodity CFD Trades

To illustrate how commodity CFDs behave, here are some hypothetical examples showing long and short positions, along with conceptual profit and loss:

Alt text: Table showing example CFD trades for gold and oil, including trade type (long or short), entry and exit prices, number of units, conceptual profit or loss, and price movement direction.

These examples are for illustration only, showing how long and short positions function and how leverage can amplify both gains and losses.

Common Mistakes or Misconceptions

Even experienced traders can encounter pitfalls. Being aware of these helps protect capital and make more informed decisions:

Believing CFDs eliminate risk because commodities are physical assets

CFDs are derivatives. Even though the underlying commodity exists physically, risk remains, and leverage magnifies both gains and losses.

Ignoring leverage and margin requirements

Not understanding your margin exposure can lead to unexpected liquidations if the market moves quickly.

Trading without understanding contract sizes or lot definitions

Each CFD’s contract size directly affects your exposure. Overlooking this can make positions riskier than anticipated.

Expecting guaranteed returns from price speculation

Commodity prices are influenced by multiple unpredictable factors: geopolitical events, supply and demand shocks, and economic announcements. No trade can promise profits.

By understanding commodities, contract sizes, leverage, and common pitfalls, traders can approach commodity CFDs with greater confidence while staying aware of potential risks.

Related Articles

Next Steps

Want to learn more?

Find out what drives commodity prices in our article on commodity trading mechanics.